New York, NY - April 5, 2018 - Attorney General Eric T. Schneiderman announced that after an industry-wide investigation into mutual fund disclosures and fees, 13 major mutual fund firms—including those run by some of the largest players in the mutual fund industry—have agreed to voluntarily publish important information about their mutual funds to all retail investors. Under the agreements announced today, the firms will disclose new information that can help retail investors determine whether a higher-cost, actively managed mutual fund fits their investment goals better than another, lower-cost alternative.

The newly disclosed information, known as Active Share, measures the percentage of stock holdings in a fund’s portfolio that differs from that fund’s benchmark index—key information investors can use to determine whether a higher-fee, actively managed fund has the potential to beat the benchmark returns of a lower-cost, passively managed fund. The AG’s investigation found that while these major mutual fund firms regularly disclosed this information to well-heeled institutional and professional investors, retail investors were often excluded.

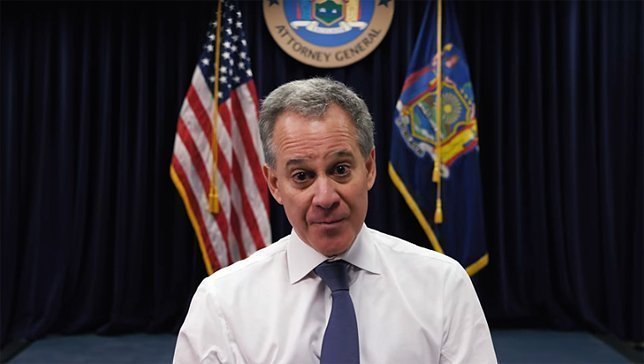

“These new disclosures will give Main Street investors access to critical information before making investment decisions for themselves and their families,” said Attorney General Schneiderman. “By working with us to help level the playing field for all investors, these firms are taking an important step forward. I encourage all mutual fund firms to follow suit.”

A report issued today by Attorney General Eric Schneiderman’s Investor Protection Bureau, “Mutual Fund Fees and Active Share,” details the findings of an investigation into fees charged by actively managed mutual funds, their disclosures to investors, and their portfolio composition relative to their fees.

The Attorney General’s investigation considered fees and disclosures for over 2,000 actively managed mutual funds – mutual funds are a popular way for investors to diversify their savings, and today, nearly half of American households invest in mutual funds, either directly through individual and retirement accounts or indirectly through other investment vehicles.

The key findings detailed in the report are:

- Actively managed funds are typically much more expensive investment options than index funds. On average, fees on an investment in an actively managed fund cost an investor almost 4.5x more per year than fees on an investment in a passive fund.

- Higher fees for actively managed mutual funds do not necessarily reflect a higher level of active management. When choosing among actively managed mutual funds, investors should not conclude that a higher fee necessarily reflects a higher level of active management, as measured by the fund’s variation from its benchmark. Based on a review of fees and disclosures for over 2,000 mutual funds, investors cannot necessarily assume that a high fee, or expense ratio, for a particular mutual fund means that the fund will have a high Active Share – in other words, an investor cannot look only to the fees charged to invest in a fund in order to assess the fund’s potential to outperform the market (or the risk of underperformance), as measured by the Active Share metric.

- Fund managers use Active Share information to help analyze mutual fund investments, and mutual fund companies provide Active Share to some professional and institutional investors, but generally not to retail investors. The Active Share metric allows investors to understand how much a particular fund overlaps with or diverges from its benchmark index. While not an absolute indicator of active management, Active Share has become a widely-used metric for mutual fund managers.

Following the Attorney General’s investigation, 13 firms agreed to make Active Share information available to all mutual fund investors by committing to publish Active Share for their actively managed, equity-based mutual funds available to U.S. investors (the 14th firm surveyed by NYOAG – Fidelity Management & Research Company – was already publishing Active Share for its relevant funds). Each of these firms will post on their websites the Active Share of the relevant funds on a quarterly basis. The firms who have agreed to publish Active Share information are: AllianceBernstein LP; BlackRock, Inc.; The Dreyfus Corporation (a subsidiary of BNY Mellon); The Capital Group Companies, Inc. (American Funds); Columbia Management Investment Advisors, LLC; Eaton Vance Management; Goldman Sachs Asset Management, L.P.; JP Morgan Chase & Co.; OppenheimerFunds, Inc.; Nuveen, LLC (a subsidiary of TIAA); T. Rowe Price Associates, Inc.; USAA Asset Management Company; and The Vanguard Group, Inc. The report recommends that all mutual fund firms provide Active Share information to all investors equally. Most of the firms that have agreed to post Active Share information will do so beginning in spring 2018.

The report also notes that investors must be more vigilant than ever in an era when the Trump administration and Congress have taken steps to roll back federal regulations that protect investors when they make retirement investment decisions, like choosing to invest in actively management mutual funds. Retail investors often rely on the advice of brokers or financial advisors, and there is significant uncertainty regarding the standard of care those advisors owe to retirement investors under federal law. Accordingly, the report concludes that Americans saving for retirement must be especially vigilant in evaluating investment choices and the investment recommendations made by their advisors. The report advises that investors should understand Active Share and can consider asking for Active Share information when making mutual fund investment decisions.

The “Mutual Fund Fees and Active Share” report was prepared by Assistant Attorneys General Desiree Cummings, Kenneth Haim, and Rebecca Reilly, Investor Protection Bureau Enforcement Section Chief Cynthia Hanawalt, and Chief of the Investor Protection Bureau, Katherine C. Milgram, with the assistance of Chief Economist Dr. Peter Malaspina, Researcher William Greenlaw, and former Data Analyst Lucas Chizzali. The Investor Protection Bureau is part of the Division of Economic Justice, which is led by Executive Deputy Attorney General Manisha M. Sheth.